International instability is creating opportunity

3 June 2020

COVID-19 has created dislocation for many reasons - be it supply chains, price fluctuations in livestock as well as financial market moves.

Despite a perceived improvement in China's supply chains as they move out of quarantine, other countries are nowhere near that phase - yes exports may still occur, but processing plants are either in shutdown or slowdown still. Some healing has come from currency fluctuations for AUDUSD as it moved from 70c in January to 55c in March, but opportunity faded in April at AUD climbed back to 65c.

As shutdowns affected airlines and transport, Oil prices were wiped out to -$40/Barrel in the front May contracts and have struggled below $20 in June contracts after the turn. This of course is a statement of low demand, bringing opportunity for those who want to export - but conversely cash flow issues for transport (i.e. Virgin Australia) would see a reduction in supply and competition for the likes of PPE (personal protective equipment).

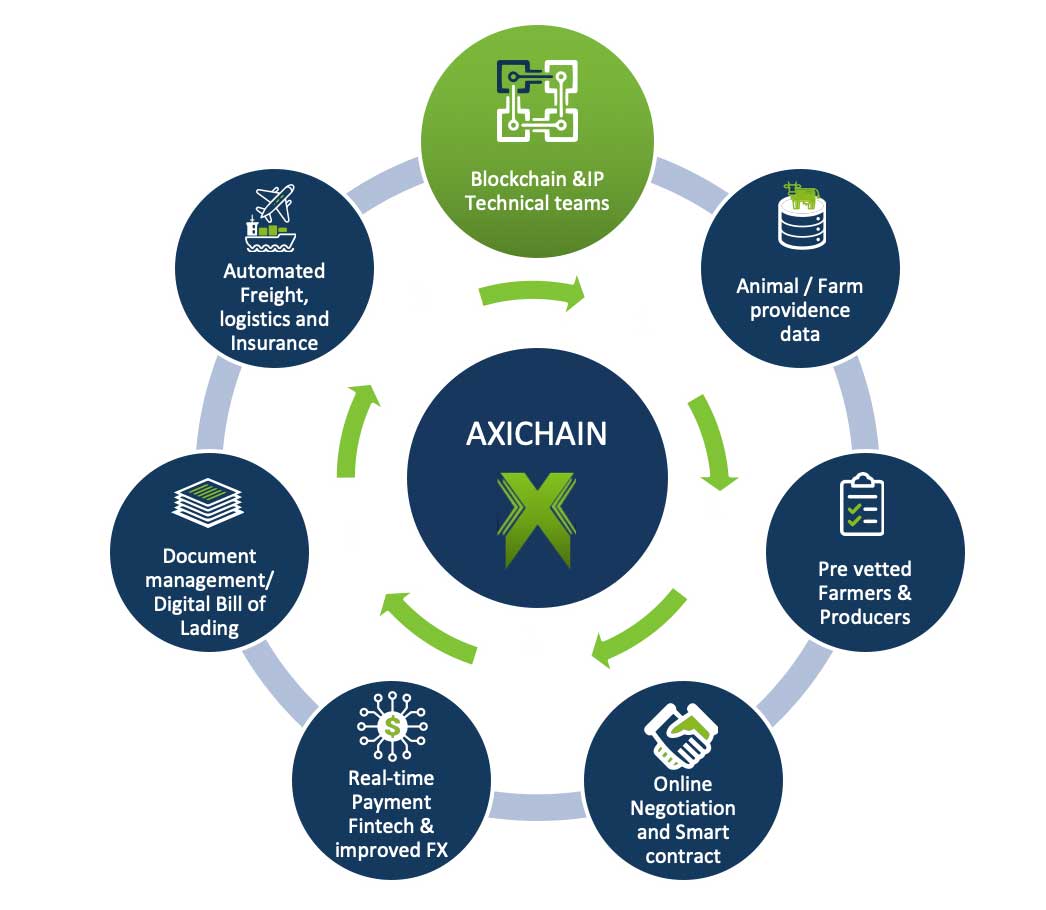

As a whole though, these components together show a competitive advantage for Australian farmers to increase exports. Post African Swine Fever causing a protein shortage in China, one could argue that's how wet markets still exist and COVID has in turn changed consumer demands towards quality and safety. This certainly creates a massive opportunity for Australia to increase its share in exporting beef. At only 20% market share, the missing elements are provenance and efficiencies in logistics - that's where AXIchain can help.

International market commentary is provided by Ben Ereira, Head of Payments and FX at AXIchain